Nuestros sitios

FOTOS Y HERRAMIENTAS DE DISEÑO

IDEAS DE DISEÑO

- Hotel Bathroom Renovation Trends in 2026

- A Complete Guide to Future-Ready Hotel Design and Investment

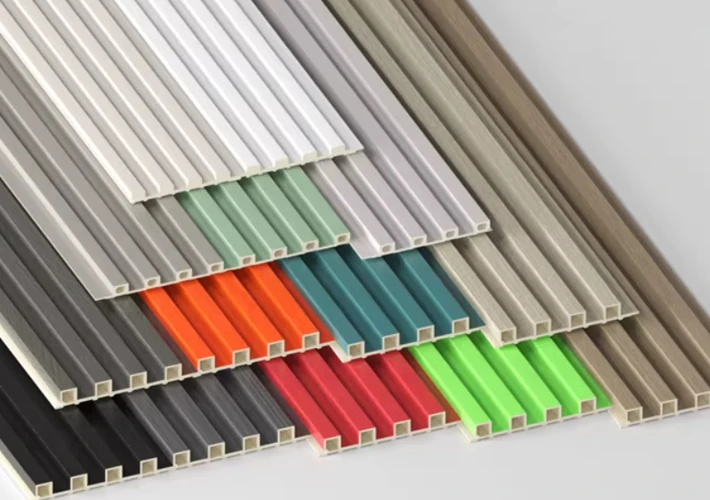

- WPC Wall Panels’ Most Popular Patterns in the UK

- Application of Black Mirror Panels in Hotel Decoration

- Benefits of Using Acoustic Panels in Hotels

- How to Choose Materials for 5 Star Hotel Bathroom Design

- Best Hotel Rest Area Design Ideas for Luxury & Comfort

- What Are Some Commonly Used Wall Panels in Hotel Bathroom Design?

SALAS Y ESPACIOS

- How Acoustic Panels Improve Sound Quality in Hotels

- Why Are More and More Renovation Projects Starting to Use Bamboo Charcoal Wood Veneer?

- Why Are More and More Hotels in the US and Europe Choosing SPC Wall Panels for Bathrooms?

- How to Choose the Right Bed for a Hotel?

- Popular Colors and Applications for Acoustic Panels

- Wooden, Metal or MDF? Best Materials for Hotel Bedside Tables

- Best Hotel Room Furniture Suppliers for 3–5 Star Hotels

- What Are the Advantages of Acoustic Panels for Office Use?

CÓMO INSTALAR

- How to Install Bamboo Charcoal Wood Veneer

- ¿Los paneles acústicos deben colocarse en paredes o techos?

- Guía paso a paso para instalar placas de mármol de PVC

- Método de instalación de paneles de pared de WPC

- ¿Cómo instalar los paneles murales SPC?

- ¿Cómo se instala la chapa de madera de carbón de bambú?

- Mejorar la calidad del sonido con paneles acústicos

- ¿Cómo instalar Bamboo Charcoal Wood Veneer?

CÓMO LIMPIAR

SALAS Y ESPACIOS

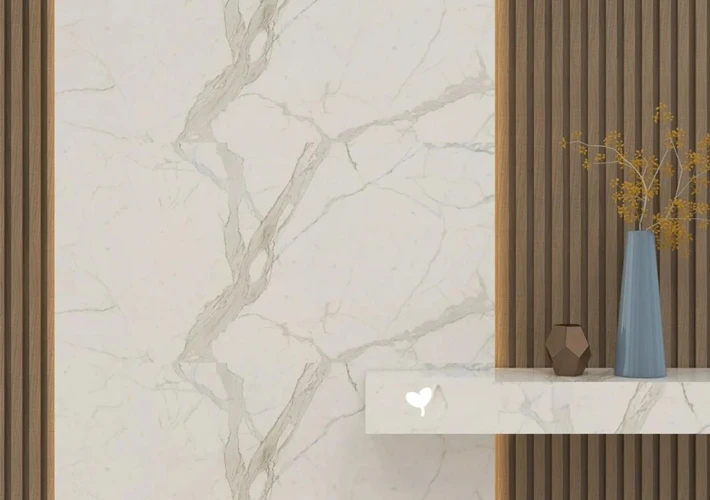

- PVC Marble Sheet Manufacturer in China for Hotel Interior Wall Projects

- Key Installation Points of WPC Wall Panel Concealed Door Systems

- Customization and Wholesale Services of PVC Marble Sheets Suitable for Star-Rated Hotel Decoration

- Estilos de diseño interior de dormitorios: Mejorar la estética con paneles de pared modernos

- ¿Puedo utilizar paneles SPC en una ducha?

- Guía de tipos de paneles murales

LOS MEJORES CONSEJOS DE EXPERTOS

- How to Shorten Hotel Guestroom Renovation Time by 30%?

- What Real Problems Will a Project Face If CE Documentation Is Incomplete?

- Bamboo Charcoal Wood Veneer Price Guide & Global Market Trends

- Top WPC Wall Panel Manufacturer and Factory for Global Projects

- Top 10 Best Acoustic Panels for Modern Interior Decoration

- How to Choose the Best Hotel Luxury Sofa for Your Project

- Latest Market Trends of WPC Wall Panels in 2025

- Common Sizes of Acoustic Wood Paneling: A Comprehensive Guide for Global Buyers

APRENDER LO BÁSICO

- Common HS Codes Used for WPC Wall Panels

- Why Malaysian Buyers Source Acoustic Panels from China

- Factors Affecting Bamboo Charcoal Wood Veneer Costs

- Why SPC Wall Panels with Stone Patterns Are Replacing Natural Marble

- WPC Wall Panel Factory vs Trading Company

- The Reasons for the Popularity of Acoustic Panels in Canada

- How UV Marble Sheets for Walls Are Manufactured

- What Is the Price of Bamboo Charcoal Wood Veneer?

COLECCIONES POPULARES

INSPIRACIÓN

COLECCIONES POPULARES

INSPIRACIÓN

COLECCIONES POPULARES

INSPIRACIÓN

COLECCIONES POPULARES

INSPIRACIÓN

INSTALACIÓN Y ASESORAMIENTO

COLECCIONES POPULARES

INSPIRACIÓN

INSTALACIÓN Y ASESORAMIENTO

INSTALACIÓN Y ASESORAMIENTO