Nos sites

PHOTOS ET OUTILS DE CONCEPTION

IDÉES DE CONCEPTION

- 2026 Hotel Bathroom Design Trends

- 2026 Hotel Lobby Design Trends

- 2026 UV Marble Sheet Design Trend

- Bamboo Charcoal Wood Veneer Marble Wall Panels for Public Spaces

- Hotel Holistic Customization for New Build and Renovation Projects

- Hotel Bathroom Renovation Trends in 2026

- A Complete Guide to Future-Ready Hotel Design and Investment

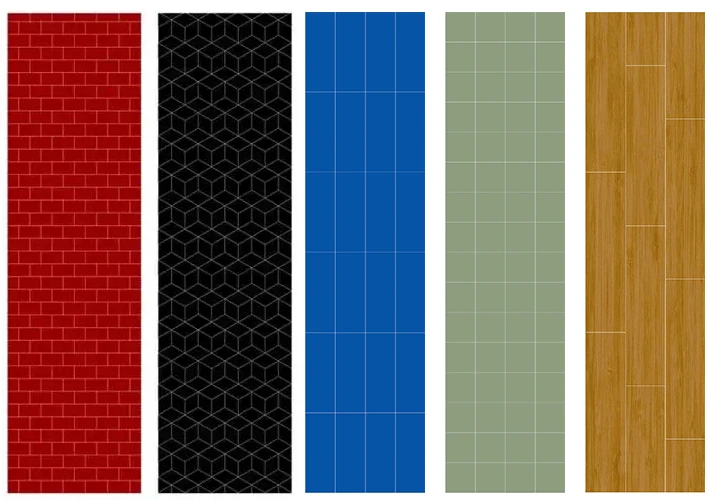

- WPC Wall Panels’ Most Popular Patterns in the UK

CHAMBRES ET ESPACES

- How Acoustic Panels Improve Sound Quality in Hotels

- Why Are More and More Renovation Projects Starting to Use Bamboo Charcoal Wood Veneer?

- Why Are More and More Hotels in the US and Europe Choosing SPC Wall Panels for Bathrooms?

- How to Choose the Right Bed for a Hotel?

- Popular Colors and Applications for Acoustic Panels

- Wooden, Metal or MDF? Best Materials for Hotel Bedside Tables

- Best Hotel Room Furniture Suppliers for 3–5 Star Hotels

- What Are the Advantages of Acoustic Panels for Office Use?

COMMENT INSTALLER

- How to Install Bamboo Charcoal Wood Veneer

- Les panneaux acoustiques doivent-ils être posés sur les murs ou les plafonds ?

- Guide de pose des plaques de marbre en PVC, étape par étape

- Méthode d'installation des panneaux muraux en WPC

- Comment installer les panneaux muraux SPC ?

- Comment installer un placage en bois de bambou et de charbon de bois ?

- Améliorer la qualité du son avec des panneaux acoustiques

- Comment installer Bamboo Charcoal Wood Veneer ?

COMMENT NETTOYER

CHAMBRES ET ESPACES

- PVC Marble Sheet Manufacturer in China for Hotel Interior Wall Projects

- Key Installation Points of WPC Wall Panel Concealed Door Systems

- Customization and Wholesale Services of PVC Marble Sheets Suitable for Star-Rated Hotel Decoration

- Styles d'aménagement des chambres à coucher : Améliorer l'esthétique avec des panneaux muraux modernes

- Puis-je utiliser les panneaux muraux SPC dans une douche ?

- Guide des types de panneaux muraux

LES MEILLEURS CONSEILS D'EXPERTS

- How to Shorten Hotel Guestroom Renovation Time by 30%?

- What Real Problems Will a Project Face If CE Documentation Is Incomplete?

- Bamboo Charcoal Wood Veneer Price Guide & Global Market Trends

- Top WPC Wall Panel Manufacturer and Factory for Global Projects

- Top 10 Best Acoustic Panels for Modern Interior Decoration

- How to Choose the Best Hotel Luxury Sofa for Your Project

- Latest Market Trends of WPC Wall Panels in 2025

- Common Sizes of Acoustic Wood Paneling: A Comprehensive Guide for Global Buyers

APPRENDRE LES BASES

- Fire Rated PVC Marble Sheet Price and Certification Cost Impact

- What are the benefits of bamboo charcoal panels?

- How to Choose the Right Acoustic Insulation Wall Panels for Commercial Projects

- Benefits of Using Acoustic Panels on Ceiling in Hotels

- How to Choose the Right WPC Wall Panel Supplier in China for Your Business

- What Are the Advantages of Oak Acoustic Panels?

- Common HS Codes Used for WPC Wall Panels

- Why Malaysian Buyers Source Acoustic Panels from China

COLLECTIONS POPULAIRES

INSPIRATION

COLLECTIONS POPULAIRES

INSPIRATION

COLLECTIONS POPULAIRES

INSPIRATION

COLLECTIONS POPULAIRES

INSPIRATION

INSTALLATION ET CONSEILS

COLLECTIONS POPULAIRES

INSPIRATION

INSTALLATION ET CONSEILS

A propos de nous

EXPLOREZ LES ÉTATS-UNIS

INSTALLATION ET CONSEILS